Payroll Calculator With Pay Stubs For Excel

Last updated on November 26th, 2024

Probably one of the most important and indispensable parts of your company is your payroll department. Whether payroll computations are done by one staff or a multitude of employees in one department, there will always be a need for payroll management or even a system for correctly and accurately computing for the whole organization’s salaries.

Easily Calculate Payroll

Even if you are a small startup or a growing corporation, you can definitely benefit from automated payroll calculation as it takes the hassle of individually computing for everyone’s hourly rates and weekly or bimonthly pay. Automating also helps speed up the process and ensures there is minimal possibility of errors that will reflect on the employees’ pay stubs or pay slips.

The Payroll Calculator with Pay Stubs for Excel is a great tool for payroll management professionals to automate their tasks without having the need to seek third-party functions. This template is very easy to use and will benefit organizations of all sizes as it is very flexible and easily customizable.

The Excel template also helps organize your information. It contains three worksheets, namely the Employee Information, Employee Calculator, and Individual Pay Stubs.

The Employee Information worksheet is where you list all your employees, their employee ID, hourly wage, tax status, state tax, income tax, Medicare tax, total withheld taxes, insurance deduction, regular deduction, and many other details. You can list as many employees as there are in your organization.

Ensure Accuracy and Security

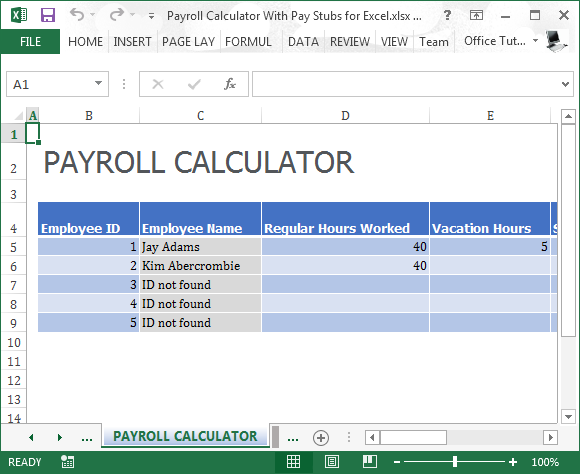

The second worksheet calculates the periodic pay off for each employee in a clean and organized table. Here, there are already built-in formulas so you can just type in the needed details such as; regular hours worked, sick hours, vacation hours, overtime hours, overtime rate, gross pay, as well as taxes and deductions, other deductions, and net pay.

Then, the last worksheet is a printable pay stub template that automatically reflects your payroll calculations. Each pay stub corresponds to each employee, making it easy for you to present individual payslips to each.

Easily Calculate Payroll

Even if you are a small startup or a growing corporation, you can definitely benefit from automated payroll calculation as it takes the hassle of individually computing for everyone’s hourly rates and weekly or bimonthly pay. Automating also helps speed up the process and ensures there is minimal possibility of errors that will reflect on the employees’ pay stubs or pay slips.