Mortgage Qualification Template For Excel 2013

Do you make enough money to afford the home of your dreams? The Mortgage Qualification Template for Excel 2013 will help you find the answer. It is a free Excel 2013 template that will calculate the mortgage amount for which you qualify.

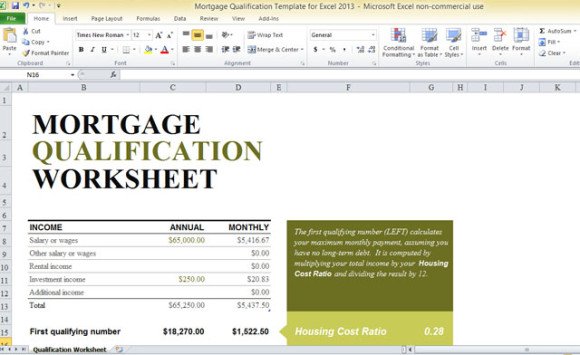

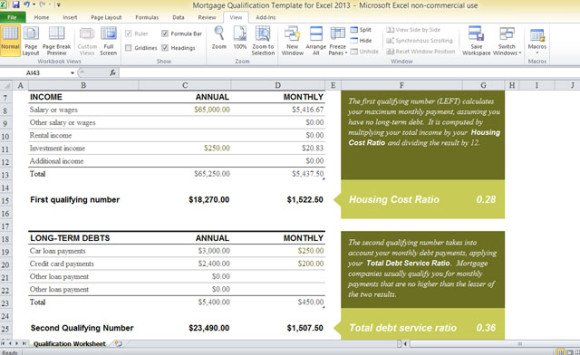

The Mortgage Qualification Template is easy to use, even for beginners Excel users. You will just input both your Monthly Income and Annual Income. From your Incomes, there are several sub-categories, where you may get your earnings. These are Salary of Wages, Other Salary or Wages, Rental Income, Investment Income, or any other Additional Income source.

Automatic Calculation

From this information, the template automatically calculates your First Qualifying number, which is your maximum monthly payment, assuming you have no long-term debt. It is calculated by multiplying your total income by your Housing Cost Ratio, which is also automatically computed by the template, and divides the result by 12.

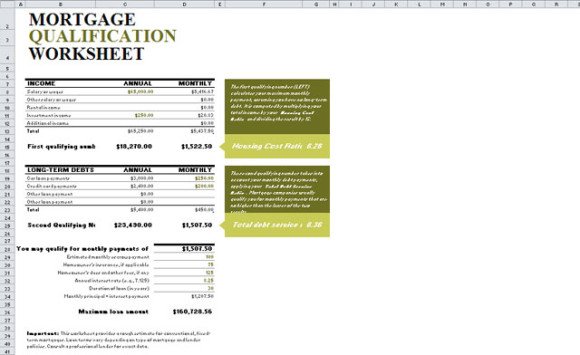

The Second Qualifying Number, on the other hand, takes into account your monthly debt payments, applying your Total Debt Service Ratio, which is automatically computed as well.

From all of this data, you will then know how much monthly payments you qualify for and your Maximum Loan Amount. However, you have to remember that this worksheet provides only a rough estimate for conventional, fixed-term mortgages. The loan term still depends on the type of mortgage and the policies of the lender.

You can download the Mortgage Qualification Template for Excel 2013 at Office.com. Another way is to open a new workbook and search from the available Office templates by just searching for mortgage in the search box.