How To Create A Loan Analysis Worksheet in Excel

Last updated on September 20th, 2024

A Loan Analysis is a method of ensuring that the loans created are made on feasible terms to clients and that they can and will pay them back. A loan analysis will also help determine which loans generate income and are eligible according to set criteria.

Other objectives of a loan analysis is to assess the financial skills of the client and evaluate the impact of the loan.

In this article, we will show you how you can create a loan analysis worksheet using this Excel template.

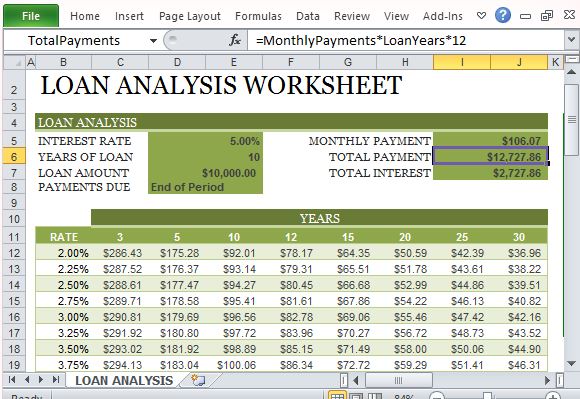

This Loan Analysis Worksheet Template is specially designed for the purpose of analyzing loans, with functions and formula built in within the worksheet.

Built-In Formula for Accurate Computations

This Loan Analysis Worksheet Template in Excel features a comprehensive table of the loan rates over the years for various terms of mortgages and installment loans. This template provides a table of comparison for the contract terms.

The template contains a table with a given set of rates and the years covered in specific terms depending on the loan to be analyzed. This data are automatically generated as soon as you enter the necessary data required on the top part of the worksheet.

Did you know? You can use a free online mortgage calculator like the Bloomberg’s Mortgage calculator to simulate a mortgage plan and compare the results accordingly to the market mortgage rates.

Know How Much You Need to Pay to Pay Off

The Loan Analysis data includes Interest Rate, Years of Loan, Loan Amount, Payments Due, Monthly Payment, Total Payment and Total Interest.

If you are planning to apply for a payday loan or already have one, this template is helpful in allowing you to see the bigger picture of your financial decision. It will also give you an idea of how long it would take for you to pay off the loan and how much you need to pay monthly.

Related: Alternatively you to this free mortgage Excel template design for Loan Analysis you can download financial PowerPoint templates and slide designs to present to a mortgage agency or make presentations on mortgage and loan analysis.

Aside from this, the loan analysis worksheet template can help you determine how much of your monthly payments go towards your loan and how much goes towards the interest.

This will help you set your own financial goals, especially when it comes to budgeting your monthly expenses to accommodate loan or mortgage payments.

Aside from banks and other financial institutions, individuals and organizations can also benefit from having a personal or business loan analysis worksheet such as this in place.