Free Cash Flow Formula

The free cash flow formula is used to describe the cash that is free to be paid back to the suppliers of capital when valuing the operations of a firm using the discounted cash flow model.

If you are creating a PowerPoint presentation and need to present the free cash flow then here we will try to help you to understand how to calculate the free cash flow.

For a particular year you can calculate the free cash flow by starting the annual sales and substracting the cash costs and depreciation. This helps to calculate the earnings before interest and taxes, aka EBIT.

In the second step you can calculate the earnings before interest and after tax. For this purpose, multiple the previous calculated EBIT value by one minus the tax rate resulting in EBIAT. This value is the after tax earnings of the firm or in other words that’s similar to say that the firm is financed entirely with the equity capital.

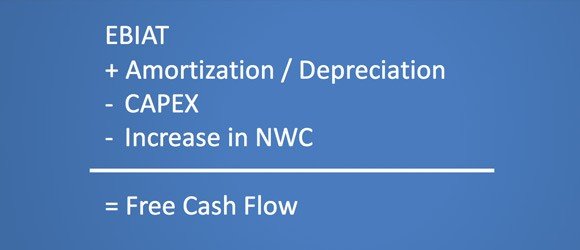

To get the free cash flow value, you’d need to add to EBIAT the expenses associated to depreciation and subtract all the capital expenditures or CAPEX. Then you’d need to subtract the investments in net working capital (aka NWC).

The final free cash flow formula can be described as: Free Cash Flow = EBIAT + Depreciation Expense – CAPEX – Increase in NWC.