Employee Or Independent Contractor Checklist Template For Excel

Finding the right person for a particular job may as well be like finding a needle in a haystack. From a pool of dozens, if not hundreds, of individuals, you should know which ones are the perfect fit for the job description and what classification they belong in. To ensure that you get the right person for the job and that you will then have a mutually beneficial relationship, you should have a system in place.

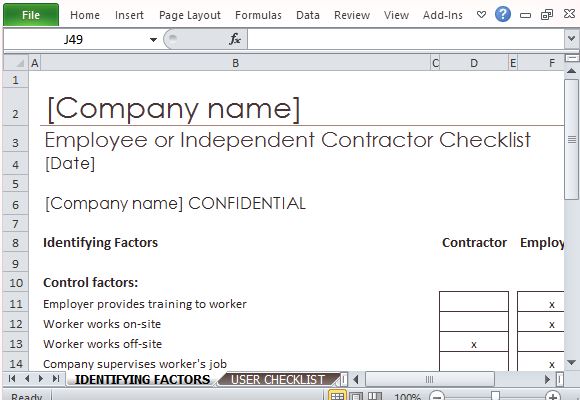

The Employee or Independent Contractor Checklist for Excel can help you figure out the contractors using a checklist to show their classifications. This template is perfect for current employees or independent contractors to see which ones are set in an hourly, fixed, or contracted rate. This template will help you sort through your employees to classify them using various factors necessary for the job to get done.

Identify Key Factors

The template is in a convenient Excel format that allows you to list factors and criteria to classify your employees or independent contractors. This is especially helpful if you have multiple employees with different functions in various departments. You can simply check on the items depending on what criteria each employee or independent contractor belongs in.

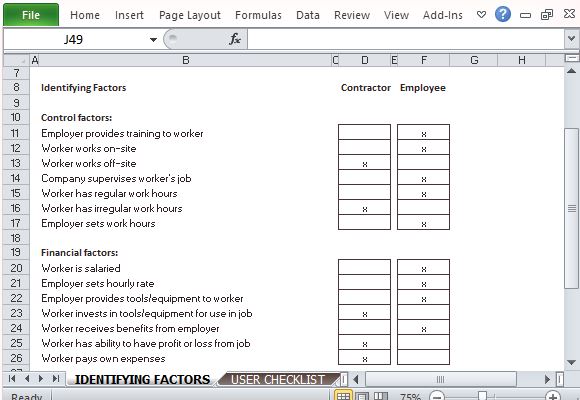

The Excel template contains two worksheet tabs, the Identifying Factors tab and the User Checklist tab. At first glance, these two tabs are very similar. They have placeholders for you to type in your Company Name at the top of the template, as well as the Date. Under the heading, you will find a list of various factors and next to each line, there are sets of two boxes under Contractor and Employee.

User-Friendly, Convenient Template

The Identifying Factors are categorized into Control Factors, Financial Factors, and Relationship Factors. The Control Factors indicates if the worker works within or outside the company premises and if the employer provides training and supervision to the employee, as well as the work hours set by either worker or company. Meanwhile, the Financial Factors include information such as the hourly or fixed rate and benefits of the employee, expenses and investments that come with the job, and many other things. The last factor contains Relationship Factors, which define any contract between employee and employer, as well as any exclusivity agreements.

The Identifying Factors Worksheet tab is where you can see the “x” marks on the appropriate boxes. The User Checklist tab is what you use for identifying and classifying contractors. You compare your checklist for each contractor against the Identifying Factors tab to determine which employee or independent contractor is best for the job you need to get done.

Go to Download Employee or Independent Contractor Checklist for Excel