Deferred Tax Rate Calculator For Excel

Deferred taxes are created when taxes are paid but not yet reflected in the income statement. Calculating this is important so you may use your deferred taxes to carry over to your future income tax expenses. Whether you are a business owner, a self-employed professional or employee, you need to know your deferred tax rate in order to make necessary income and budget planning.

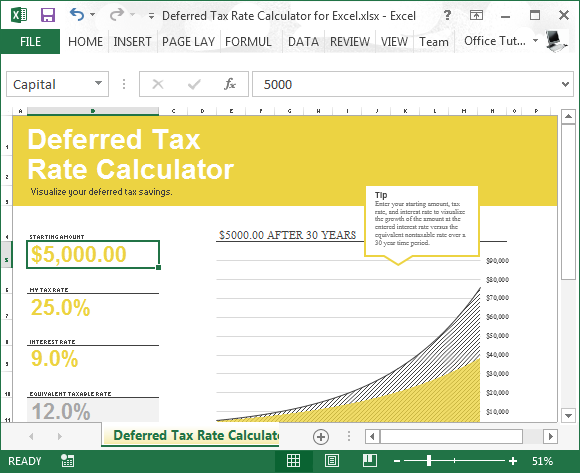

Deferred Tax Rate Calculator

The Deferred Tax Rate Calculator for Excel is a professionally designed template that you can use to compute for your deferred tax rate. This is a free calculator specially designed to allow you to accurately compute for your deferred tax rate by just typing in the needed information.

With this deferred tax rate calculator, you don’t need to be an accounting professional, or even hire one to compute for your taxes. You don’t even have to be an expert in Excel. The template is easy-to-use and even easier to navigate and understand, so anyone one with any level of knowledge in Excel can benefit from this template.

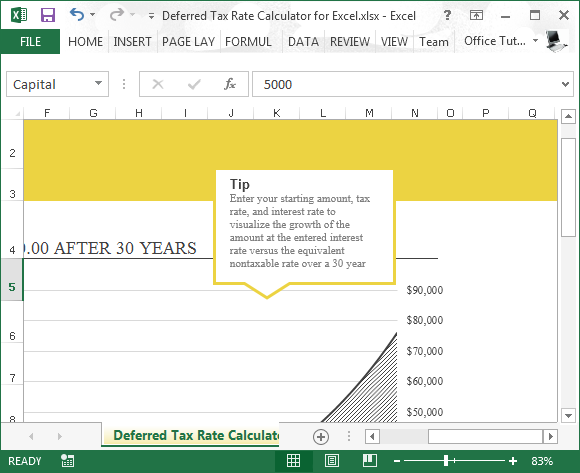

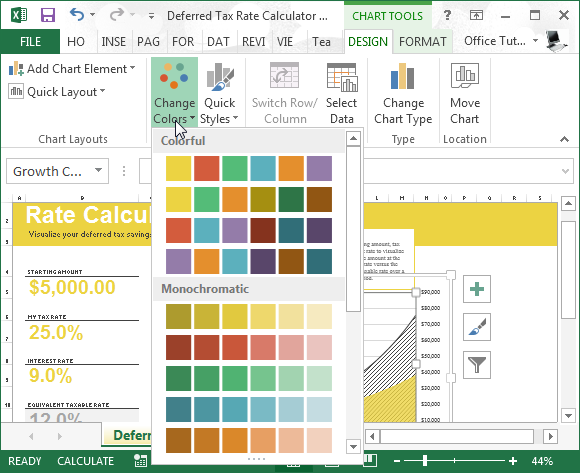

This Excel template not only accurately computes for your deferred tax rate using built-in formula, it also displays your results in a visual manner for you to use in presentations and reports, or if you simply want a print-out of your calculated deferred tax rate.

Accurate Results Everytime

Since this template is free, you can use it many times for your business, employees, colleagues, and friends. You can also upload this template to your OneDrive account for easy access whenever you need it for reference, or if you want to compute for new deferred tax rates.

You can also easily share this template to others for free, through OneDrive’s powerful sharing tools. Using your smartphone, tablet, or any other computer, you can access this template via OneDrive account, making it very convenient for you to have a tax calculator whenever you need one.