Car Buy vs Lease Calculator For Excel

If you are in the market for a new car or vehicle, then you should know that there are many things to consider to ensure that you are investing in the right vehicle and that you are making a wise financial decision. While in the process of choosing a car, you may even be on the fence as to whether you will buy a car or lease it instead.

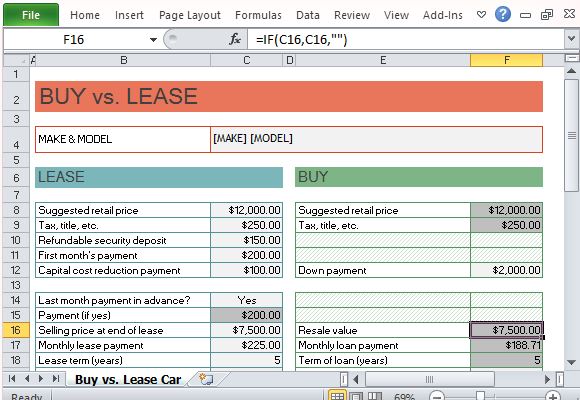

The Car Buy vs Lease Calculator for Excel is a wonderful tool to help you objectively weigh your options in order to make the best decision in the long run. This Excel template is specially designed for those who have the debacle of buying or leasing a car.

Make a Wise Financial Decision

This calculator template contains built-in functions and formula to make things easier for you and to ensure that you get the accurate information all the time. Regardless of the make and model of the car, you can compute for the comparisons between buying and leasing it, to see which one will meet your own financial goals better.

The template features a single worksheet that contains a set of tables created alongside each other in order to make comparisons much easier for you. The layout, design and theme is created attractively to even allow you to simply embed your own comparison calculations in your personal financial records, or as a report to your company or organization. The template is both functional and attractive at the same time.

Objectively Weigh Your Options

Whether you are a newbie when it comes to Excel worksheets, or you are already highly knowledgeable, you can use this Car vs Lease Calculator. To compute for the car you plan to acquire, you can type the make and model on the corresponding cell on the top part of the template. Meanwhile, you can input the lease and buy details associated with that specific model.

For lease, you can type in data such as Suggested Retail Price; Tax, Title and Other Expenses; Refundable Security Deposit; First Month’s Payments; Capital Cost Reduction Payment, Selling Price at End of Lease, Lease Terms, Discount for Present Value, and many more.

If you want to buy the car or vehicle instead, you can consider the following data: Suggested Retail Price; Tax, Title and Other Expenses; Down Payment; Resale Value; Monthly Loan Payment; Initial Costs, Financing Costs, and Present Value of Total Costs.

At the end of the table, you can see that the template automatically computes for the Difference, with a Note to guide you. A positive value means the Difference is in favor of leasing while a negative value is in favor of buying. The template also features Taxation Data.